The Use of Flow-Through Shares in the Canadian Mining Sector Amidst COVID-19

The use of flow-through shares (“FTSs”) is particular to the resource sector in Canada. Many companies in the mining sector issue FTSs to help finance their exploration and project development activities, while at the same time, providing certain tax benefits to investors. Especially in the midst of the COVID-19 pandemic, this is particularly attractive to junior resources companies who often find it difficult to raise capital, while being in a non-taxable position with no need to deduct any of their resources expenses. The final quarter of the year is also an excellent time for issuers looking to undergo an offering of FTSs, as investors are aware of the gains they are looking to offset for the year, and are considering tax planning strategies in order to do so.

Mechanics of Flow-Through Shares

The basic premise underlying the use of FTSs is twofold: (1) companies in the mining industry typically have little, if any, net income for tax purposes and, as such, these companies regularly find themselves with unusable tax deductions; and (2) the resource sector, particularly the mining industry, is capital intensive, requiring companies to raise financing to explore their properties and remain competitive. To alleviate these issues, FTSs serve as a tax-based financing incentive that allows eligible principal business corporations (as defined in the Income Tax Act (Canada) (the “ITA”)) (referred to hereinafter as, the “Issuer”) to renounce certain expenditures to investors purchasing FTSs of the corporation. Through this, the Issuer incurs a flow-through obligation (a set amount of expenditures the Issuer must renounce to the investor) in exchange for the capital inflow from the investor.

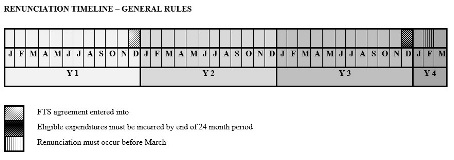

To meet this obligation, qualifying expenditures must generally be incurred within 24 months after the end of the month in which the flow-through subscription agreement is made (the “General Rule”). Effectively, these incurred expenditures are treated as if they had been incurred by the investors themselves, qualifying them for the applicable tax deductions. The Issuer must incur qualified expenditures in an amount at least equal to the subscription price of the FTS. An investor can then claim a deductible amount up to the consideration they originally paid for its FTSs. The Issuer must then renounce the qualifying expenditures in favour of the investors by no later than the end of February in the year following the end of the 24-month period.

Source: Instructions for the Flow-Through Share Program, Canadian Revenue Agency

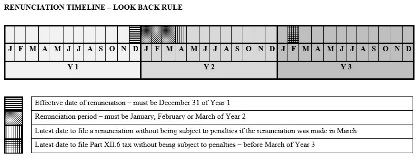

Notwithstanding the foregoing, there is a special rule (the “Look-Back Rule”) which allows the Issuer to renounce certain expenditures as of a time before the time those expenses are actually incurred. Only certain expenditures, including “grassroots” Canadian exploration expenses (“CEE”) (as defined in the ITA), are subject to the Look-Back Rule, which permits an Issuer to renounce such expenses incurred within an entire calendar year, effective as of the last day of the preceding calendar year, provided certain conditions are met, including that the Issuer and the holders of the FTSs deal at arm’s length. When an Issuer renounces CEE using the Look-Back Rule, it is subject to special tax under Part XII.6 of the ITA. In addition, if the Issuer fails to incur the amount of CEE renounced in the prescribed time, an additional tax of 10% of the unspent CEE is payable by the Issuer.

Source: Instructions for the Flow-Through Share Program, Canadian Revenue Agency

Qualifying Expenditures

As set out in the ITA, Issuers are permitted to deduct for tax purposes the following mining expenditures:

- “Grassroots” Expenditures – These include any expenses incurred for the purpose of determining the existence, location, extent or quality of a Canadian mineral resource. These include expenses from prospecting, carrying out geological, geophysical or geochemical surveys, drilling, trenching, digging test pits and preliminary sampling. Grassroots CEE does not include, among other things, expenses incurred to acquire a depreciable property or expenses related to a mine already producing in commercial quantities, including any extensions of such mines.

- Pre-production Expenditures – These include any expenses incurred to bring a new mine into production in reasonable commercial quantities, which is generally achieved when there is 60% mill capacity for a 90-day period. These include expenses incurred for clearing, removing overburden, stripping, sinking a mine shaft or constructing an adit or other underground entry, so long as the expenses are incurred before the mine comes into production in the reasonable commercial quantities. It does not include the cost of depreciable property and expenses related to a mine already in commercial production. These expenses can be allocated into either the exploration or development category, which determines how much the investor can deduct from the amount renounced.

- Post-production Expenditures – These include any expenses incurred in sinking or excavating a mine shaft, main haulage way or similar underground work designed for continuing use for a mine in a mineral resource in Canada built or excavated after the mine came into production. The cost of a mineral resource property does not qualify for FTS purposes, nor do any expenses included in the cost of depreciable property.

The most common form of these deductible expenditures that are subsequently renounced to meet flow-through obligations is Grassroots CEE, since Grassroots CEE are expenditures permitted under the Look-Back Rule. Grassroots CEE are most commonly incurred by junior mining companies; a primary factor in why such companies rely so heavily on issuances of FTSs as a form of financing.

In addition to the general industry risks associated with junior mining companies, due to a lack of cash flow and the inherently risky nature of their operations, junior mining companies have faced several difficulties as a result of COVID-19 that have made the continued use of such flow-through financing rather onerous. These difficulties include: disruptions in supply chains, a lack of workforce continuity, increased expenditures to enhance safety protocols during the pandemic, and a reduced or complete shutdown of mine sites leading to decreased exploration efforts. With less exploration work comes decreased Grassroots CEE, making it difficult for junior mining companies to not only meet their current flow-through obligations, but also to raise further financing through the issuance of FTSs.

This becomes evident when considering that a majority of FTS issuances are structured in a way that allows the investor to take advantage of the Look-Back Rule. This can shorten the Issuer’s timeline to incur eligible expenditures to as little as 12 months, making flow-through obligations difficult to meet in ordinary circumstances absent COVID-19.

Extension to Timelines Due to COVID-19

To help alleviate some of these abovementioned issues relating to COVID-19, the Department of Finance Canada announced a proposal in July 2020 that it would extend the timelines for incurring eligible expenses applicable to Issuers of FTSs by 12 months. The proposal stands to provide relief particularly to, among others, junior mining exploration companies with operations that have been impacted by COVID-19. The extension would apply to agreements entered on or after March 1, 2018 and before 2021 when using the General Rule, and only for those agreements entered in 2019 or 2020 when using the Look-Back Rule.

Issuers should also be aware of any specific terms of the agreements relating to the FTSs issued. If there are any concerns with being able to meet obligations relating to the FTSs issued, Issuers should consider mitigation strategies in order to deal with any added taxes or penalties attributable to such potential breaches.

With Canadians currently looking for secure investments, this extension could serve to help attract investors to FTS investments by decreasing the timing risks associated with Issuers not meeting their flow-through obligations. This extension also provides impacted Issuers with a degree of much needed flexibility in preserving and expending cash, and in navigating these uncertain times.

The Mines & Minerals Group at Aird & Berlis can advise on all aspects of a mining company’s activities, including mining disclosure standards, tax planning, technical reports and recruitment of qualified persons. For more information, please visit our Mines & Minerals webpage.

*The author would like to thank Kevin Miri, a 2020 summer student, for his assistance with this article.