Key Takeaways From 2023 Appellate Decisions

For 2023, our annual summary of key Supreme Court of Canada and Ontario appellate cases with commercial implications includes:

- Reframing of the public benefit test for adverse possession

- Assessing whether the contents of an employer’s investigation report are protected by the doctrine of “qualified privilege”

- Guidance on piercing the corporate veil and the oppression remedy

- Direction on when the duty of good faith may include a duty to inform

- Clarification of the presumption of loss in a breach of the duty of honest performance

- Clarity about when the normal measure of damages is presumptive

- Consideration of the presumption of consistent expression in contractual interpretation

- Determination of when a material change has occurred under securities law

- Direction on when deemed admissions in a pleading can result in debt surviving bankruptcy

- Clarity about what constitutes a withdrawal of an admission in a pleading

Reframing the Public Benefit Test to Create a Rebuttable Presumption

In Kosicki v. Toronto (City), 2023 ONCA 450, the majority of the Court of Appeal provides the first appellate commentary regarding the public benefit test, proposed by the Superior Court,[1] that municipal parkland is unavailable for adverse possession, and reframes the test creating a rebuttable presumption rather than a complete bar.

In Kosicki, the relevant facts were as follows: the City of Toronto was the registered owner of a strip of land. Before 1972, a fence was erected around the disputed land by the property of the then-owners Pawel Kosicki and Megan Munro (the “Homeowners”). In 2021, the Homeowners approached the City about purchasing the disputed land. The City, based on its policy, refused to sell. The Homeowners brought a claim for adverse possession.

While the application judge found that the Homeowners’ claim would have met the threshold for adverse possession, the judge concluded that publicly owned land of this kind is “immune” to such claims.

The central question raised on the appeal was whether private landowners can gain title over municipal parkland through adverse possession. The majority set out a single question to be addressed in applying the public benefit test: claims in adverse possession against municipal parkland at common law will generally not be available, unless it can be shown on the evidence, that the municipality waived its presumptive rights, acknowledged or acquiesced to such possession. The court accordingly created a rebuttable presumption, rather than a complete bar, to the rule that municipal parkland is unavailable for adverse possession.

Contents of an Investigation Report Protected by the Doctrine of Qualified Privilege

In Safavi-Naini v. Rubin Thomlinson LLP, 2023 ONCA 86, the Court of Appeal held that workplace

investigations may be matters of public interest, passing the threshold test for anti-SLAPP protection under the Courts of Justice Act (“OCJ Act”),[2] where allegations arise at a public institution,

garner media attention and raise public safety concerns. The court also upheld the motion judge’s finding of qualified privilege applying to statements made by the investigator in summaries of the workplace and sexual harassment investigation.

A medical resident at the Northern Ontario School of Medicine (“NOSM”) alleged that both her program director and a NOSM faculty member sexually harassed her. NOSM investigated her complaints. After the investigation was completed, the investigator submitted executive summaries to NOSM containing her findings, including insights into the resident’s credibility. Each respondent and select staff at NOSM received copies of the summaries. The medical resident commenced an action against the investigator and her law firm alleging that the summaries were defamatory. The defendants moved to dismiss the medical resident’s action under s. 137.1 of the OCJ Act. As we explained in further detail in our recent article, a defendant may move under s. 137.1 of the OCJ Act for an order dismissing the proceeding. The lower-court judge granted the defendants’ motion and dismissed the medical resident’s action.

The Court of Appeal upheld the dismissal of the medical resident’s action. In particular, the court held that the workplace investigation summaries engaged the public interest, due to the nature of NOSM as an educational institution, the media attention garnered and the public safety concerns arising from the allegations.

With respect to the motion judge’s application of qualified privilege, the court held that the respondents’ provision of the executive summaries to NOSM falls squarely within the scope of qualified privilege.[3] As required under s. 32.0.7 of the Occupational Health and Safety Act, the respondents were retained to investigate allegations of workplace harassment and to prepare investigation reports for NOSM. Thus, NOSM had a legal duty to provide, in writing, the results of the investigation and any corrective action taken to the complainant and her alleged harassers.

Corporate Director’s Conduct Results in Oppression Remedy

In FNF Enterprises Inc. v. Wag and Train Inc., 2023 ONCA 92, the Court of Appeal held that a director was personally liable under the oppression remedy for knowingly stripping value from the corporation to the prejudice of creditors.

The defendant, Linda Ross, was the sole director, officer and shareholder of the corporate defendant, Wag and Train Inc. (“W&T”). The plaintiffs, FNF Enterprises Inc. and 2378007 Ontario Inc. (the “Owners”), leased commercial premises to W&T and failed to pay amounts owing under the lease.

The Owners asserted two key causes of action against Ms. Ross: (1) oppression pursuant to s. 248 of the Business Corporations Act (Ontario) (“OBCA”);[4] and (2) her conduct justified lifting the corporate veil. The Owners alleged two key categories of conduct by Ms. Ross: (1) she misused corporate powers for her own benefit by stripping value from W&T and causing the same business to be carried on elsewhere to avoid payment of amounts known to be owing; and (2) she controlled W&T and thus made the decisions which caused it to breach the lease. On Ms. Ross’s motion to strike, the judge struck out both causes of action and the Owners appealed.

With respect to the oppression remedy claim, the Court of Appeal held that W&T’s allegations that Ms. Ross stripped value from W&T to avoid payment of amounts known to be owing presented an arguable case for a personal remedy against her under the oppression remedy. In light of the allegation of unpaid amounts owing to creditors, Ms. Ross, as sole shareholder, was not entitled to use W&T’s money as her own or to appropriate its business, nor could she, as sole director, confer either upon herself. The court further stated that the power of a director to declare a dividend to shareholders is subject to the corporation being able to pay its creditors, pursuant to s. 38(3) of the OBCA, but that a shareholder of a corporation does not have a right to the corporation’s assets while it is ongoing, unless the corporation is wound up. Upon winding up, a shareholder’s right to payment or to receive assets is subject to the prior rights of unpaid creditors, pursuant to s. 221(1)(a) of the OBCA.

With respect to the claim of piercing of the corporate veil, the Court of Appeal agreed with the lower court that it should not be lifted, but for different reasons. The court relied upon Transamerica Life Insurance Co. of Canada v. Canada Life Assurance Co.[5] that, in order to pierce the corporate veil, a moving party must satisfy the court of: (1) not just ownership or control of a corporation, but complete domination or abuse of the corporate form; and (2) fraudulent or improper conduct that has given rise to the liabilities the plaintiff seeks to enforce.

The court held that the mere fact that a director or officer decided a corporation should breach a contract is not the type of improper conduct that justifies piercing the corporate veil. The link between the wrongful conduct claimed and the liability sought to be imposed by piercing the corporate veil was missing from the facts of the case: the Owners did not specifically allege a shield for fraudulent or improper conduct, for example, that stripping value from W&T constituted misappropriation of the Owners’ funds.

Duty of Good Faith May Include an Implied Duty to Inform

In Ponce v. Société d’investissements Rhéaume ltée,[6] the Supreme Court of Canada considered the scope of the duty to inform and the duty of good faith under the Civil Code of Quebec in the context of a share buyout between parties subject to a pre-existing contractual agreement.

With important implications for share purchasers bound by a prior contractual arrangement, the court held that a duty to inform the vendors could both be implied via contract and derived from the proactive and prohibitive dimensions of the requirement to act in good faith. The duty of good faith imposes on each contracting party a duty to inform that encompasses their partner’s legitimate expectations. Though decided under the Quebec Civil Code, Ponce will no doubt also have implications when assessing the contractual duty of good faith in common law jurisdictions.

In Ponce, the majority shareholders of Groupe Excellence (“GE”)(the “Majority Shareholders”) had entered into an incentive pay agreement (the “Presidents Agreement”) with the presidents of GE (the “Presidents”) which governed the relationship between the parties while they worked towards the goal of ensuring the success of GE as an ongoing business, with a view to its eventual sale. The Presidents learned of and did not inform the Majority Shareholders of a potential acquisition offer from Industrial Alliance Insurance (“IA”), instead entering into a confidentiality agreement between the Presidents and IA which prevented IA from dealing directly with the Majority Shareholders with respect to any acquisition. Absent knowledge of the potential acquisition by IA, the Majority Shareholders sold their shares in GE to the Presidents. Months later, the Presidents resold their shares in GE to IA for more than double the price of acquisition. Upon learning of the sale, the Majority Shareholders claimed the Presidents breached the requirements of good faith. The Majority Shareholders’ claim was successful before the Quebec Court of Appeal.

The Supreme Court of Canada held that the appeal by the Presidents should be dismissed. In particular, the court upheld the finding of the Court of Appeal that the Presidents had breached the duty of good faith owed to the Majority Shareholders and that an implied duty to inform arose from the contract.

First, the court held that the Presidents Agreement governing the relationship between the parties, similar to a contract for services, had as its purpose the maximization of the value of the business with a view to eventual sale. The court held that while the Presidents were not required to subordinate their interests to the Majority Shareholders, they were nonetheless required to act in their best interests. Given the nature of the agreement, and in reliance upon arts. 1375 and 1434 C.C.Q., the court held that this included an implied obligation of the Presidents to inform the Majority Shareholders of IA’s interest in an acquisition, as this information may have helped the Majority Shareholders make a decision regarding the sale and price of their holdings in GE.

Second, the court held that the Presidents’ conduct breached both the proactive and prohibitive dimensions of the requirement to act in good faith required by art. 1375 C.C.Q. In breach of the prohibitive dimensions of good faith, the court held that the Presidents conducted themselves in a disloyal manner by failing to inform the Majority Shareholders of IA’s interest and by signing the confidentiality agreement. The court held that the Presidents had breached the proactive dimensions of good faith by failing to take active behaviour to inform the Majority Shareholders of information within their legitimate expectations (and still within the Presidents own interests). In holding that the proactive dimension of good faith includes a duty to inform, the court relied upon the criterion to determine whether particular information fell within the duty to inform laid down in its decision in Bank of Montreal v. Bail Ltee.,[7] and found the criterion to be satisfied in this case.

With respect to a remedy, the court held that disgorgement of profits is not an appropriate remedy where there has been a breach of the obligation of good faith by a person who is not subject to an obligation of loyalty, instead holding that damages must be determined in the ordinary course based upon the injury sustained. However, the court held that compensatory damages could be awarded for the loss sustained pursuant to art. 1611 C.C.Q., in reliance upon the presumption set out in Biotech Electronics Ltd. v. Baxter,[8] which draws from the common law and holds that where a breach of the requirements of good faith prevents the aggrieved party from proving the injury sustained, it should be presumed that the injury is equivalent to the profits made by the party at fault. Based upon this presumption, in the absence of the Presidents refuting the onus of establishing that the Majority Shareholders would have sold their shares to IA for a price lower than that obtained by the Presidents, the Majority Shareholders were entitled to the difference between the sale price received from the Presidents and what was paid by IA.

The court’s guidance on how purchasing shareholders with a pre-existing contractual arrangement should conduct themselves provides helpful guidance in both civil and common law jurisdictions. The court’s discussion of both proactive and prohibitive dimensions of the requirement to act in good faith serves as a reminder of the importance of the proactive dimension of this duty which is often overlooked.

Finally, the court’s damages award confirms at civil law that where a breach of good faith prevents a party from proving their damages, it is presumed and the burden falls on the defendant to disprove that the injury is equivalent to the wrongdoer’s gain.

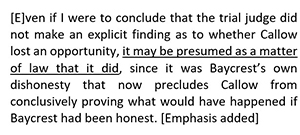

Breach of Honest Performance Does Not Necessarily Presume Loss

In Bhatnagar v. Cresco Labs Inc., 2023 ONCA 401, the Ontario Court of Appeal clarified that the Supreme Court of Canada’s decision in CM Callow Inc. v. Zollinger, 2020 SCC 45 (“Callow”) does not create a mandatory presumption of loss once a court finds a breach of the contractual duty of honest performance. Instead, in the absence of exceptional circumstances, the court interpreted Callow to require a plaintiff to show that loss resulted from a breach before a party becomes entitled to damages. The Court of Appeal’s approach to damages with respect to the breach of the duty of honest performance aligns with the ordinary approach to damages in contract law which requires a plaintiff to show loss for damages to be awarded and confirms that any presumption of loss, as was discussed in Callow, is the exception rather than the rule.

Through a share purchase agreement (the “SPA”), 2360149 Ontario Inc., operating as 180 Smoke (“180 Smoke”) was sold to Origin House (“Origin”) in February 2019. The SPA gave the shareholders the opportunity for additional payments if 180 Smoke met certain revenue targets in the three years following closing and obtained a processing license within a certain period. The parties also negotiated a clause whereby, if Origin was later sold, the vendors of 180 Smoke would be entitled to payment of all yearly unearned milestone payments as of the date of Origin’s sale. In April 2019, Origin announced it was being sold to Cresco Labs Inc. (“Cresco”). The transaction was initially scheduled to close in late 2019 but ultimately closed in January 2020. The shareholders of 180 Smoke were provided with future unearned milestone payments for 2020 and 2021 but were not provided with payment for the 2019 year as revenue targets were not achieved in 2019 and because 180 Smoke was only entitled to unearned yearly milestone payments on a go-forward basis from the date of close.

180 Smoke brought an application for payment of the 2019 revenue milestone payment and license fee alleging that failure to achieve the 2019 revenue target was a result of Origin’s breaches of contract, including Origin’s failure to promptly advise 180 Smoke of the delayed closing date of the Cresco transaction. 180 Smoke submitted, in reliance on Callow (as excerpted to the right) that, if Origin had breached its duty of honest performance, the court was required to presume damages. While the application judge found that Origin had breached its duty of honest performance of the SPA by failing to update 180 Smoke about the revised closing date, the judge rejected 180 Smoke’s interpretation of Callow finding that despite Origin’s breach, there was no evidence of lost opportunity by the shareholders who had proffered no evidence that they would have been able to meet 2019 revenue targets or force the Cresco transaction to close by the end of 2019 had they been informed of the revised closing date.

On appeal, 180 Smoke made submissions that the application judge erred in her interpretation of Callow by failing to presume loss as a result of the breach of the duty of honest performance. Cresco cross-appealed the finding that they had breached their duty of honest performance.

The Court of Appeal held that the application judge did not err in refusing to presume loss as a result of the breach of the duty of honest performance. The use of the word “may” in Callow was stated to run contrary to the submissions of 180 Smoke that, once the court found a breach of the duty of honest performance, it was obliged to presume that they had suffered a loss of opportunity. The court held that Callow placed the burden on the claimant to show evidence that the breach caused the loss or resulted in the claimant being unable to protect their interests.[9] The court also allowed the cross-appeal on the basis that the application judge erred in finding that the shareholders were unaware in 2019 that there would be a delay in the closing of the transaction.

Normal Measure of Damages Is Presumptive

The Court of Appeal in The Rosseau Group Inc. v. 2528061 Ontario Inc., 2023 ONCA 814 (“Rosseau”) overturned the Superior Court’s departure from the “normal measure of damages” (being the difference between the contract price and the market value of the land on the closing date), confirming that such measure is presumptive.

The purchaser and the vendor entered into an agreement for the sale of development lands (the “APS”) for approximately $6.6 million. The purchase did not close. The purchaser brought an action alleging breach of the APS and sought the profits it claimed it would have earned had it acquired and developed the property into residential lots for a period after closing. The judge found that the vendor had breached the APS and granted judgment in favour of the purchaser, awarding a median of the estimated damages. The judge noted that the purchaser had acquired the property with the intention of earning a profit by developing it and that these were special circumstances that justified the departure from the normal measure of damages.

On appeal, the court held that it was an error to rely solely on the parties’ contemplation of future development to justify a departure from the normal measure of damages. The term “special circumstances” known to the parties at the time of contracting, in the context of damages for breach of contract, is a reference to the second of the two branches of the remoteness test based on Hadley v. Baxendale: damages may be recovered if: (1) they arise fairly, reasonably and naturally as a result of the breach of contract; or (2) they were within the reasonable contemplation of the parties at the time of contract. Importantly, the remoteness test deals with the type of loss that is recoverable; the measure of loss is about how the loss is quantified.

The court reiterated that regardless of the branch of the remoteness test into which the loss falls, the normal measure of damages should not be departed from unless the party seeking damages shows that the measure of loss does not address that type of loss. In Rosseau, the trial judge made no such finding. The court held that the concept of “market value” already takes into account the value of the land, including that it can be developed, and that, unless the type of loss is not otherwise accounted for, the normal measure of damages should be followed.[10]

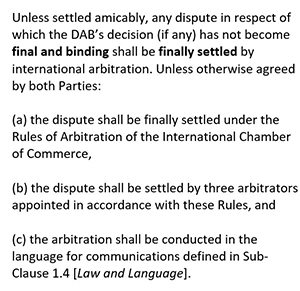

Presumption of Consistent Expression in Contractual Interpretation Is Limited

Drawing upon the Supreme Court of Canada’s guidance in Sattva Capital Corp. v. Creston Moly Corp.[11] and the principle that contractual interpretation is not to be dominated by technical rules of construction, the court in Baffinlands Iron Mines LP v. Tower EBC examined the presumption of consistent expression – the presumption that “language in a contract is used consistently, with the same words meaning the same thing and, by corollary, the use of different words indicating an intention to refer to different things” in the context of two similarly worded phrases. In denying the appeal, the Court of Appeal emphasized the importance of the practical approach to contractual interpretation holding that the presumption of consistent expression should not be interpreted as the dominating rule of contractual construction and interpretation when the ordinary meaning of words is otherwise clear.

Baffinlands Iron Mines LP (“BIM”) sought leave to appeal an arbitral tribunal award (the “Award”). Ontario’s Arbitration Act contemplates three different scenarios regarding appeals to the court on questions of law. The arbitration agreement may expressly provide for, be silent on, or preclude such appeals. In the first scenario, there is an appeal as of right; in the second, there is an opportunity to appeal but only with leave; and, in the third, there is no appeal or right to seek leave to appeal at all.

The dispute resolution provision in question (excerpted to the right) made use of two distinct phrases, “finally settled” and “final and binding,” the latter of which has been interpreted as precluding appeals to a court. The question before the court was whether the presumption of consistent expression required the phrase “finally settled” to have a different meaning than the phrase “final and binding,” supporting the conclusion that the use of inconsistent phrasing was meant to preserve a party’s right of appeal to the court.

The application judge rejected BIM’s argument that the phrases “final and binding” and “finally settled” in the agreement had different meanings, finding that the arbitration agreement dealt with appeals and precluded them by saying that appeals would be “finally settled” by arbitration. The application judge denied BIM’s application for leave to appeal.

On appeal, BIM argued the application judge failed to properly apply the presumption of consistent expression. In denying BIM’s appeal, the Court of Appeal reiterated that “the primary concern of contractual interpretation is to give effect to the intent of the parties by reading the contract as a whole, giving the words used their ordinary and grammatical meaning, in light of the factual matrix where that is relevant”[12] and “it is important not to treat the presumption (of consistent expression) as a dominating technical rule of construction that overwhelms the interpretation of a contract.”[13] The court concluded that the presumption of consistent expression should not be applied to force a different meaning of a phrase where the ordinary meaning of different words and phrases is clearly the same.

With respect to the phrases at issue, the Court of Appeal held that the presumption of consistent expression had been correctly considered by the application judge who applied a consistent interpretation of the word “final” across both phrases, holding that the phrases “final and binding” and “finally settled” by arbitration both mean that a party has no further recourse by way of appeal.

Two-Step Test to Determine a Material Change Under the Ontario Securities Act

In the companion decisions, Markowich v. Lundin Mining Corporation, 2023 ONCA 359 (“Markowich”) and Peters v. SNC-Lavalin Group Inc., 2023 ONCA 360 (“Peters”), the Ontario Court of Appeal clarified the applicable analysis as to whether a development impacting a business constitutes a “material change” requiring disclosure within the meaning of s. 75(1) of the Ontario Securities Act (“OSA”).[14]

Before Markowich, the leading authority on “material change” under s. 75(1) of the OSA was the Supreme Court of Canada’s decision in Kerr v. Danier Leather Inc., 2007 SCC 44 (“Danier”). In Danier, the court stated that to determine whether there has been a “material change” requires a two-step analysis: (1) has there been a change in the business, operations or capital of the issuer, and (2) if there was a change, was it material?

In both Markowich and Peters, a motion for leave under the OSA and for certification under the Class Proceedings Act[15] were brought and subsequently dismissed. The Court of Appeal reversed the motion judge’s decision in Markowich, finding that the meaning of “change” was approached “too narrowly.” Further, the motion judge’s errors in interpreting “change in the business, operations or capital” led him to err in his assessment of the evidence.[16] The court provided assistance in determining whether there has been a “material change” as follows:

- the definition of “change” was not meant to include its magnitude, but rather its qualitative nature;

- the magnitude of the change is not meant to be assessed at the first stage of the definition but rather in the second part, which is focused on materiality;

- changes in the business, operations or capital of an issuer can qualify as a material change, as long as they are “material” in the sense that they “would reasonably be expected to have a significant effect on the market price or value of any of the securities of the issuer”;

- materiality is objectively determined from the perspective of a reasonable investor and the applicable standard is defined in strictly economic terms.[17]

In contrast, the Court of Appeal upheld the lower court in Peters. The court pointed out that the distinction between “material change” and “material fact” is relevant to understanding the meaning of “material change.” Specifically, the term “material fact” is necessary when an issuer is publishing a disclosure document where all material information concerning the issuer at a point in time (emphasis added) is published in one document. The term “material change” is “limited to a change in the business, operations or capital of the issuer. This is an attempt to relieve reporting issuers of the obligation to continually interpret external political, economic and social developments as they affect the affairs of the issuer (emphasis added), unless the external change will result in a change in the business, operations or capital of the issuer […]”.[18]

Leave to the Supreme Court of Canada in Markowich was granted on March 28, 2024.

Deemed Admissions by Virtue of a Default Judgment Can Result in Debt Surviving Bankruptcy

The court in Convoy Supply Ltd. v. Elite Construction (Windsor) Corp., 2023 ONCA 373 confirmed that a judgment against a personal defendant can survive bankruptcy pursuant to s. 178(1)(d) of the Bankruptcy and Insolvency Act (“BIA”), where there are admissions of misappropriation by a fiduciary.

Convoy Supply Ltd. (“Convoy”) commenced a claim against the Appellants for, among other things, damages for breach of trust, an order to continue the action against any defendant that has made an assignment in bankruptcy, as well as an order, pursuant to s. 178(1)(d) of the BIA (which sets out several circumstances in which a discharge order does not release a bankrupt from debt), that any damages award made in the action would not be discharged in the event that the defendant made an assignment in bankruptcy. Default judgment was granted against Elite Construction (Windsor) Corp. and the corporation’s officer, director, guarantor and directing mind, Kostas Michos (together, the “Appellants”). After default judgment was granted, Mr. Michos made an assignment into bankruptcy.

Convoy brought a motion to, among other things, amend the default judgment to add declarations that the debt owed by the Appellants to Convoy, pursuant to the default judgment, arose from Mr. Michos committing misappropriation or embezzlement while acting in a fiduciary capacity and that, as a result, pursuant to s. 178(1)(d) of the BIA, the debt owed survived bankruptcy. The motion judge recognized that for a judgment debt to trigger s. 178(1)(d), “the debt must arise from conduct that displays at least some element of wrongdoing or improper conduct that would be unacceptable to society because of its ‘moral turpitude or dishonesty’” and that the Appellants were deemed to admit the facts pleaded in the claim as a result of the default judgment. Convoy was successful on the motion.

The Appellants appealed and argued, among other things, that the motion judge erred in finding, on the record before the court, that the judgment debt arose from misappropriation or defalcation in relation to the trust funds. The Court of Appeal held that the motion judge correctly considered the factors in concluding that the deemed admissions in the claim satisfied the element of “wrongdoing or improper conduct” required to trigger s. 178(1)(d) of the BIA such that the debt from the default judgment survived bankruptcy.

Some key factors considered by the motion judge included:

- The deemed admissions were acts of Mr. Michos converting or appropriating trust funds for his own use or a use inconsistent with the trust; and

- The default judgment included an award of punitive damages which, as the motion judge noted, was based on a pleading (deemed admitted) that the conduct of the Appellants was “misconduct that markedly departs from ordinary standards of decent behaviour.”[19]

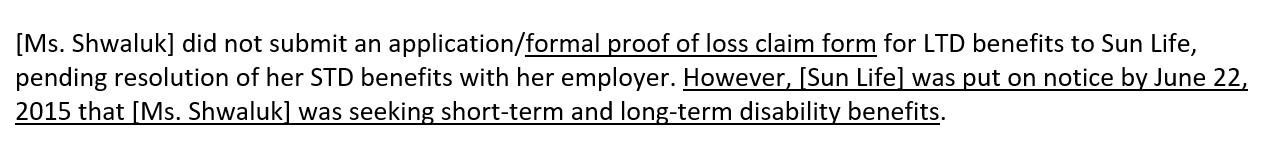

What Constitutes a Withdrawal of an Admission in a Pleading?

In Shwaluk v. HSBC Bank of Canada, 2023 ONCA 538 the court clarified that an admission

in a pleading may relate to a fact or to a legal consequence − a position − alleged to flow from the fact. In determining whether a proposed amendment withdraws an admission in a pleading, the nature and extent of the admission is a key

consideration.

Emma Shwaluk appealed the dismissal of her motion for leave to amend her pleadings to add particulars and relief from forfeiture. The proposed amendment stated (proposed amendment in underlining):

In her original claim, Ms. Shwaluk alleged that Sun Life intentionally failed to pay benefits, although it was obligated to do so. Sun Life’s defence responded that Ms. Shwaluk failed to file a timely application for benefits, which was fatal to

her benefits entitlement. The motion judge held that in her proposed amended pleadings, Ms. Shwaluk sought to withdraw an admission and was statute-barred from seeking relief from forfeiture on new facts that had not been previously pled. Moreover,

permitting the proposed amendments would result in fundamentally different claims than those originally pleaded.

The Court of Appeal found that the motion judge incorrectly concluded that Ms. Shwaluk sought to withdraw an admission.[20] The court reiterated that to determine whether an amendment results in the withdrawal of an admission depends upon:

(1) the nature and extent of the admission in the original pleading; and (2) the difference between the original pleading and the proposed amended pleading regarding what was admitted. When considering the nature and extent of an admission, a court

must consider whether the admission makes a “deliberate concession to a position taken by” the other party and/or accepts that “a set of facts posed by” the other party is correct.

The court held that the proposed amendments maintained both that no application was submitted and Sun Life’s position that a fatal consequence flowed from it. The court further held that the motion judge erred in treating the proposed amendments

as involving the withdrawal of an admission and therefore incorrectly applied the test of whether leave to amend should be granted under r. 26.01. Further, the request for relief from forfeiture in the amended pleadings was not a new claim and

such a request was not statute-barred.

The Aird & Berlis Litigation & Dispute Resolution Group acts in all forms of dispute resolution – civil lawsuits,

quasi-criminal proceedings, administrative proceedings, appeals, mediation, private arbitrations or other alternate dispute resolution. Please contact the authors or a member of the group for more information on the implications of 2023 appellate

decisions.

*Hannah Downard, an articling student at Aird & Berlis, also contributed to this article.

[1] Oro-Medonte (Township) v. Warkentin, 2013 ONSC 1416 at para 119.

[2] Courts of Justice Act, R.S.O. 1990, c. C.43.

[3] The Court adopted the Supreme Court of Canada’s definition of “qualified privilege” in 2020 SCC 23 holding that qualified privilege exists “if a person making a communication has an interest or duty, legal, social, moral or personal, to publish the information in issue to the person to whom it is published” and the recipient has “a corresponding interest or duty to receive it.”

[4] Business Corporations Act, R.S.O. 1990, c. B.16.

[5] Transamerica Life Insurance Co. of Canada v. Canada Life Assurance Co. (1996), 1996 CanLII 7979 (ON SC), 28 O.R. (3d) 423 (Gen. Div.), aff’d [1997] O.J. No. 3754 (C.A.).

[6] Ponce v. Société d’investissements Rhéaume ltée, 2023 SCC 25 [Ponce].

[7] [1992] 2 S.C.R. 554.

[8] Biotech Electronics Ltd. v. Baxter [1998] R.J.Q. 430 (C.A.).

[9] Bhatnagar v. Cresco Labs Inc., 2023 ONCA 401 at para 55 [Cresco Labs].

[10] The normal measure of damages is presumptive for two reasons: (1) damages are awarded on the principle that a party should be put in the position it would have been in had the contract had been performed; and (2) an early, and predictable, date on which the party’s damages are crystallized promotes efficient behaviour and reduces uncertainty.

[11] Creston Moly Corp. v. Sattva Capital Corp. 2014 SCC 53 [Sattva] at paras. 36, 47.

[12] Sattva at paras. 47, 57.

[13] Baffinland Iron Mines LP v. Tower-EBC G.P./S.E.N.C., 2023 ONCA 245, para. 37.

[14] S. 75(1) of the Ontario Securities Act, R.S.O. 1990, c. S. 5 requires a reporting issuer to “forthwith issue and file a news release” in circumstances “where a material change occurs in the affairs of [the] reporting issuer.” S. 1(1) of the OSA defines “material change” in relation to a reporting issuer as: a change in the business, operations or capital of the issuer that would reasonably be expected to have a significant effect on the market price or value of any of the securities of the issuer [emphasis added]. Determining whether and when there has been a change in an issuer’s business, operations or capital often proves challenging.

[15] 1992, SO 1992, c 6.

[16] Markowich v. Lundin Mining Corporation,2023 ONCA 359 at para 7 [Markowich].

[17] Ibid at paras 80-81.

[18] Peters v. SNC-Lavalin Group Inc., 2023 ONCA 360 at para 72 [Peters].

[19] Ibid.

[20] Rule 51.05 of the Rules of Civil Procedure, R.R.O. 1990, Reg. 194 provides that: “an admission in a pleading may be withdrawn on consent or with leave of the court.”