City of Toronto ‘Puts the Brakes’ on New Commercial Parking Levy

On January 28, 2025, the executive committee of Toronto city council received a report from the city’s chief financial officer and treasurer with respect to the introduction of a commercial parking levy in the City of Toronto (the “City”). The report concluded that, in order to successfully implement this new levy, the City would need to rely on the Municipal Property Assessment Corporation (“MPAC”) to administer it. MPAC maintains property assessment data, supports technology upgrades and has experience handling audits, reconsiderations and appeals.

MPAC has advised the City that it would need board approval in order to do so and “may require engagement with appropriate provincial government officials.” The matter has therefore been postponed until such time as the City hears back from MPAC, which means that levy implementation, originally slated for 2025, will not take place earlier than 2026.

What Is the Proposed Parking Levy?

In February 2024, City staff presented the concept for the commercial parking levy to the executive committee, proposing a new form of taxation on owners of commercial off-street parking within the City, including both private and public (i.e., Toronto Transit Commission, Toronto Parking Authority) commercial properties, and both unpaid and fee-paid parking facilities, including surface parking, underground parking and parking garages.

Who Will Be Subject to the Levy?

The parking levy will be limited to those properties within the Commercial Tax Class. Therefore, properties that are in the Industrial Tax Class will not be subject to the tax. However, it should be noted that industrial warehouses and distribution centres are classified as Commercial and would, therefore, be subject to the tax.

In short, the parking levy will impact office buildings, retail plazas, warehouses, entertainment facilities and grocery stores, among other types of properties.

How Will the Levy Be Calculated?

The current proposal is to apply a two-zone rate structure based on geographic area:

- Zone A – Downtown and Central Waterfront

- Zone B – The rest of the City

Zone A will be taxed at an annual rate of $6 per square metre of parking (equivalent to approximately $180 per parking space* annually).

Zone B will be taxed at an annual rate of $3 per square metre of parking (equivalent to approximately $90 per parking space* annually).

*assumption is that one parking space is approximately 30 square metres, including access lanes.

The first 300 square metres of any property will not be subject to the parking tax. That is equivalent to approximately 10 parking spaces, based on the City’s calculations.

Will Any Properties Be Exempt From the Levy?

Properties that are already exempt from property taxes under the City of Toronto Act, 2006 and the Assessment Act will not be subject to the parking levy.

City staff is considering broadening the exemptions to include parking required for business operations, such as loading bays, vehicle storage and vehicle maintenance areas, parking associated with charitable institutions (although those are likely exempt anyway) and accessible parking.

How Much Will the City Benefit From the Levy?

It is the City’s expectation that the parking levy will have a positive impact on City priorities and objectives, including reducing congestion and positively contributing to climate action, by encouraging Torontonians to use transit or other means to travel.

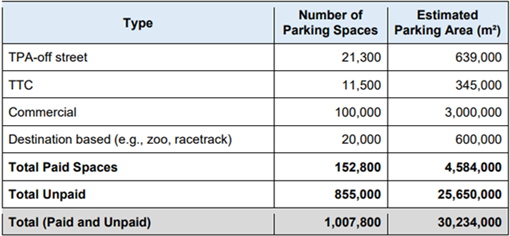

Preliminary estimates suggest that the parking levy may generate gross revenues of $100 million to $150 million annually. This is based on the following estimate of the parking inventory in the City available to be taxed:

The Municipal & Land Use Planning Group at Aird & Berlis LLP is available to advise on the City of Toronto’s proposed commercial parking levy and its potential impact on property owners. Please reach out to the author or a member of the group for more information.